Accounting School blog established with an aim to provide provide free accounting, finance, management, tax and audit study material for accounts professionals as well as to students.

Wednesday, February 5, 2020

Accounting Basis and Policies

Accounting policies are the specific accounting bases judge by business enterprises to be most appropriate to their circumstances and adopted by them for the purpose of preparing their financial accounts.

Accounting basis are the various methods which have been developed for applying fundamental accounting concepts to financial transactions and to items in financial statements. Accounting bases are used for constructing accounting figures which are variable. These are methods developed for determining the;

Accounting periods in which revenues and costs should be recognised in the profit and loss account.

Amount at which material items should be stated in the balance sheet.

Example of Accounting Basis

Let’s suppose that a business unit is required to provide for depreciation of its fixed asset and stock valuation at the end of the each accounting period.

So, that, the following the accrual or matching concept;

Stock items can be set out against the sales proceeds of those items in future accounting period.

Example

Stock on actual value $15,000 Revalue at $ 17,780 on sales price

Assets can be shown at their carrying values in the Balance Sheet.

Example

Asset on cost value $80,000 on Carrying value after Depreciation of 10%

$80,000X10/100=$8,000 $72,000

Tuesday, February 4, 2020

Accounting Equation Examples

Example No.1

Let’s assume that ABC introduces / invest money in business i.e (Capital/Owner Equity) for $ 100 on December 31, 2019, ABC’s accounting equation is;

Example No.2

Purchased plant on credit for $500.

Example No.3

Purchased machine on credit $2,500.

Example No.4

Creditor paid off by cheque for $4,000.

Example No.5

Drawings by arranging bank overdraft for

$4,700.

Example No.6

Drawings of cash $ 15,000.

Example No.7

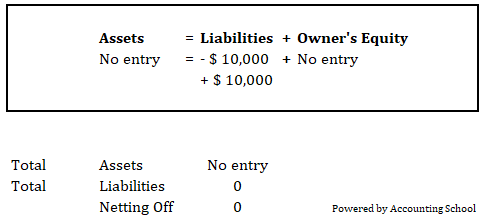

Creditors paid-off by arranging loan $

10,000.

Example No.8

Further capital introduced to pay-off

creditors $7,500.

Monday, February 3, 2020

What is Accounting Equation?

1- It is the basis of double entry

system of accounting.

2- It says that every transaction have two side effects.

3- Recording of two aspects of each transaction.

4- Assets and liabilities are two independent variables.

5- Capital is the dependent variable.

2- It says that every transaction have two side effects.

3- Recording of two aspects of each transaction.

4- Assets and liabilities are two independent variables.

5- Capital is the dependent variable.

Accounting transaction may affect both sides

of the equation by the same amount or on one side of the equation only, by both

increasing and decreasing it by equal amount and thus netting to ZERO.

Let’s assume that ABC introduces / invest

money in business i.e (Capital/Owner Equity) for $ 100 on December 31, 2019, ABC’s

accounting equation is;

Basic Accounting Principles

Basic accounting principles are accounting

standards that have been generally accepted and have pervasive impact on the

form and content of financial statements.

Duality

Duality is the basic characteristics of

accounting transaction which is embodied in double entry system. The claims against

assets of a business are by the creditors and the owners. Therefore, at any point of time,

the total assets of a business are equal to its total liabilities. Liabilities to outsiders are known as

liabilities, but liability to the owners in accounting is referred as capital.

This concept expresses the relationship that

exists among assets, liabilities and the capital, in the form of an accounting

equation which is expressed in the following simplest form as

ASSETS – LIABILITES = CAPITAL

OR

ASSETS = LIABILITES + CAPITAL

Sunday, February 2, 2020

Going Concern

It is not possible to determine in

advance the life-span of business unit. Accounting is based on the assumption that

the business unit will be operating for long. When business is started, it is

assumed that business will not be dissolved in the near future.

Profit & loss, balance sheet is

drawn up on the assumption that the business will continue functioning in the foreseeable

future.

Accounting system provides the continuous

record of business unit.

Business unit will continue its

operations under same economic conditions.

It is not assumed that business unit

will be profitable as long as it exists.

FACTOR TO

DETERMINE BUSINESS UNIT AS GOING CONCERN

a. Business must have sufficient liquid

assets i.e (cash, stock, bonds etc)

b. Shortage of liquid assets may lead to

the risk of insolvency.

Capital Structure

a. Business must have sound capital

structure.

b. Long term funds and short term

financing to overcome difficulties.

Market

a. Business unit must have strong market demand

product.

b. Goods, services or trading products

should have market demand.

Management Ability

a. Business unit should be managed

efficiently, effectively.

b. Must have clear objective to increase

the wealth of owners.

c. Plan, procedure, policies and practices

should be used.

Basic Accounting Assumptions

Ø Accounting Entity

1. Sole

proprietor

4. Non-profit making organization

We

must for the book-keeping, keep the owner and his business quite separate. Only

those economic affect the business unit are recorded. Assuming that business

unit is a separate entity, accounting records are kept only from the point of

view of the business unit and not the owners.

We

must for the book-keeping, keep the owner and his business quite separate. Only

those economic affect the business unit are recorded. Assuming that business

unit is a separate entity, accounting records are kept only from the point of

view of the business unit and not the owners.

To ascertain the return on capital employed.

To ensure proper use of funds.

To hold title to property in the name of the firm.

To enter into business with outsiders.

Stability in the value of money

Ø Money Measurement

Ø Going Concern

Ø Accounting Period

Accounting

Entity

A

business entity is an organization of persons to accomplish an economic goal. An

entity is defined as those undertakings under the control of a single

management as;

2. Partnership

firm

3. A

company4. Non-profit making organization

We

must for the book-keeping, keep the owner and his business quite separate. Only

those economic affect the business unit are recorded. Assuming that business

unit is a separate entity, accounting records are kept only from the point of

view of the business unit and not the owners.

We

must for the book-keeping, keep the owner and his business quite separate. Only

those economic affect the business unit are recorded. Assuming that business

unit is a separate entity, accounting records are kept only from the point of

view of the business unit and not the owners.

Example

Mr.

B starts a business as X & Co., accounts are to be prepared from the point

of view of X & Co., as if it was a different person from the owner.

This

concept applies to all the form of business organizations for the following

reasons;

Solution

to business and personal transactions of the owner.To ascertain the return on capital employed.

To ensure proper use of funds.

To hold title to property in the name of the firm.

To enter into business with outsiders.

Money Measurement

It is the medium of exchange. It provides

a uniform way to measure the value of goods services. It makes exchange more

efficient. Finally, money is a store of value. Money is one form in which wealth

can be maintained.

The accounting system uses money as

its basic unit of measurement. All business transactions are recorded in terms

of money; it is a useful way of converting accounting data into a common unit.

Under this concept,

only those transactions which can be measured in terms of money are to be

recorded in the books of account.

Problem with

Money Measurement

Stability in the value of money

Rs.

1 a year from now will buy the same

amount as it does today.

Factors of Vital Importance

Factors to the business are outside the

purview of accounting.

This is because they are matters of opinion

and cannot be expressed in monetary terms.

Conclusion

For the above two reasons, the money measurement

concept is not ideal. It is recognized by all accountants that the concept has

its limitations and inadequacies.

Accounting Concepts and Conventions

GAAP

set of rules can provide uniformity in the

Accounting system

Accounting procedure

Presentation of accounting results

Accounting

assumptions are those broad concepts that develop GAAP principles, upon which accounting

is based. Certain ideas and rules are assumed in account in order to provide a

unifying theoretical structure and internal logic of accounting.

The

assumptions are rule of the game and they have been developed

from common accounting practices.

Generally Accepted Accounting Principles (GAAP)

Generally

accepted accounting principles are the conventions, rules and procedures necessary

to define accepted accounting practice at a particular time. These principles

provide a foundation for measuring and disclosing the results of business

transaction and events.

GAAP

are conventional, that is, they become generally accepted by agreement rather

than by formal derivation from as se of postulates or basic concepts.

GAAP

are conventional, that is, they become generally accepted by agreement rather

than by formal derivation from as se of postulates or basic concepts.

How

GAAP Developed

The

principles are developed on the basis of experience, reason, custom, usage and

to a significant extent, practical necessity. These principles are widely used

and accepted that may be produced to underline and accounting statements.

Role

of Accountant

GAAP

instructs an Accountant what to do in the usual case when he has no reason to

doubt that the affairs of the organization are being honestly conducted. Since

he has reason to believe that this basic assumption is false, an entity

different situation confronts him.

Saturday, February 1, 2020

Reliability, Relevance, Understand-ability, Comparability in Accounting Information

Reliability

Accounting information should be

reliable. It gives the user confidence and trust. It is reasonable

representation of actual items or event that has occurred. Accounting

information should be error-free and neutral; an accountant’s bias must not

color his information.

Relevance

Accounting information must be

relevant to the user. It is relevant if it needs of the user in decision

making. Relevance is defined in the terms of the ability to affect a

decision-maker’s course of action.For information to be relevant, it must have some being on the decision being made. Relevant information should be capable of making difference in a decision by helping user of accounting information form predictions about the outcomes of past, present and future event.

Understand-ability

Understand-ability is the quality of accounting information that enables user to perceive its significant, i.e to understand the content and significance of accounting statements and reports. To have the characteristics of understand-ability, accounting information must be presented in a manger that users can understand, i.e it must be expressed in terminology that is understandable to the user.

It is necessary that user of the

accounting information must attain a minimum level of competence in

understanding the terminology user in accounting statements.

It is assumed that the users have

a basic knowledge of business accounting, and they will spend some time and

effort in studying the accounting statements. However, the accountant has a

basic responsibility to describe business transactions clearly and concisely.

Usefulness is enhanced in accounting information can be compared with similar information for the same organization at different times, and for different organizations at the same time. It enhances the value of accounting information.

Absoluteness of the accounting is

not of much use, it is the comparability that lens itself to proper decision

making.

To achieve comparability,

consistency and disclosure of accounting policies are necessary.

Subscribe to:

Comments (Atom)